Daily General Analysis

October 12, 2024

Financial Market Analysis with Focus on the Most Relevant News of the Moment

Reading the latest news, I couldn't help but be amazed by the performance of Taiwan Semiconductor Manufacturing Company (TSMC), whose ADRs surpassed the $190 mark. This, combined with the outlook for their upcoming conference on the 17th, signals a potential significant impact on the global electronic industry landscape. The fact that Nvidia is projecting additional gains, thanks to the increasing demand for their GPU chips, and the news that their Blackwell GPU is sold out for the next 12 months, only solidifies the optimism surrounding the semiconductor sector.

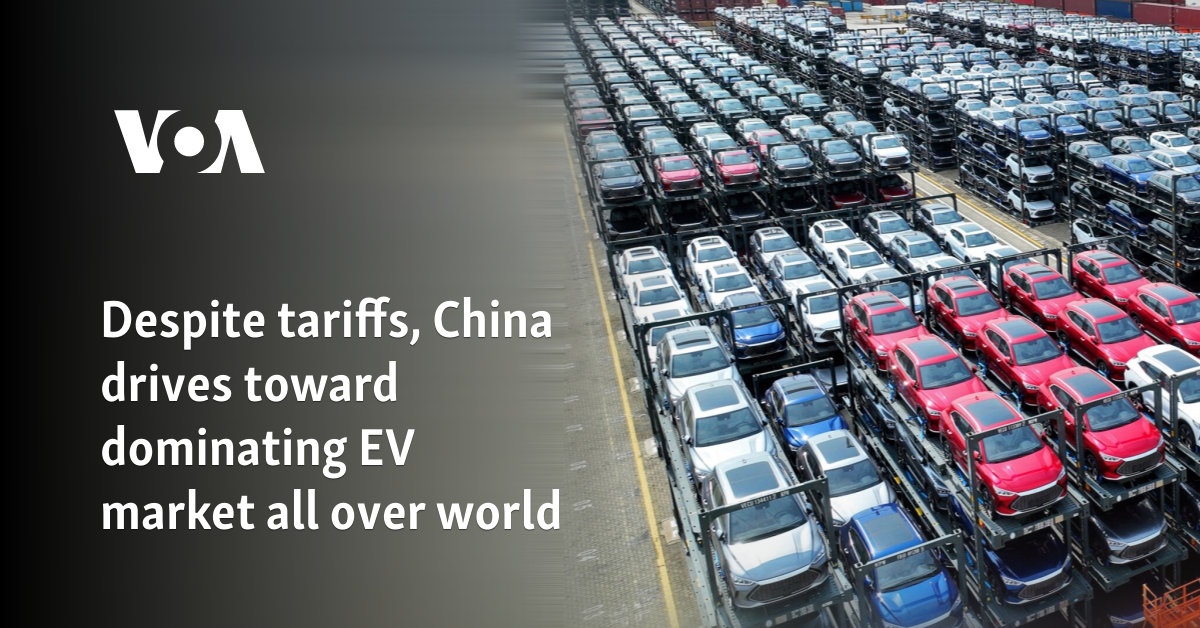

Meanwhile, China's influence in the global electric vehicles (EVs) market shows no signs of slowing down, despite tariff disputes with the European Union. This is a clear indicator of China's resilience and growing dominance in this crucial sector. Additionally, with Tesla possibly being undervalued by 40%, according to Wedbush analysis, and MicroStrategy's revelation aiming to become a "Bitcoin bank" with a trillion-dollar valuation, the markets seem to be at a significant turning point.

Insights and Reflections:

1. Semiconductors as the Foundation of Technological Innovation: The appreciation of TSMC and the optimism surrounding Nvidia highlight the fundamental importance of the semiconductor industry as a driver of current technological innovation. Investments in leading companies in this sector can offer solid returns, given the increasing demand for chips in various applications, from electric vehicles to AI and cloud computing.

2. China Leading the Future of EVs: China's determination to dominate the global electric vehicle market should be seen as an investment opportunity in Chinese EV companies and global companies that strategically align with this vision.

3. Transportation Transformation with Tesla: Tesla's futuristic vision with its robotaxi suggests a paradigm shift in the concept of urban mobility. Investing in Tesla now could mean betting on a potential leader in this future "Transportation as a Service" market.

4. Explosive Growth of Cryptocurrencies and Financial Innovation: MicroStrategy's initiative to become a "Bitcoin bank" underscores the disruptive potential and intrinsic volatility of the cryptocurrency market. Diversification into digital assets, especially in Bitcoins, can serve as a hedge against inflation and a new source of capital growth.

5. Geopolitical Risks and Global Inflation: The potential conflict between Israel and Iran and its impact on oil prices serve as a reminder that geopolitical factors can reintroduce inflation and volatility into global markets. Investment strategies should include diversification to mitigate these risks.

Investment Suggestions:

- Semiconductor ETFs: To capture sector growth without exposure to individual company risk.

- Chinese EV Companies Stocks: Companies like NIO and XPeng can benefit from China's leadership in the EV market.

- Tesla (TSLA): Considering the potential undervaluation and future innovative releases.

- Bitcoin and Other Digital Assets: Considering the volatility but also the potential for significant growth.

- Commodities and Energy ETFs: As a hedge against potential inflation shocks derived from geopolitical instabilities.

Conclusion: Recent news highlights the importance of staying informed and ready to adapt investment strategies to the rapid market changes. The combination of technological innovation, geopolitics, and financial transformation is shaping new opportunities and risks, requiring careful analysis and a balanced approach to maximize returns while managing risk exposure.

:max_bytes(150000):strip_icc()/GettyImages-2177157887-6e070b7d35364fcfa018a09661b7f183.jpg)