Daily General Analysis

October 13, 2024

Today, I delved into some of the hottest and most fascinating news in the world of technology, economy, and stock market that are undoubtedly shaking up the markets and shaping the near future of investments.

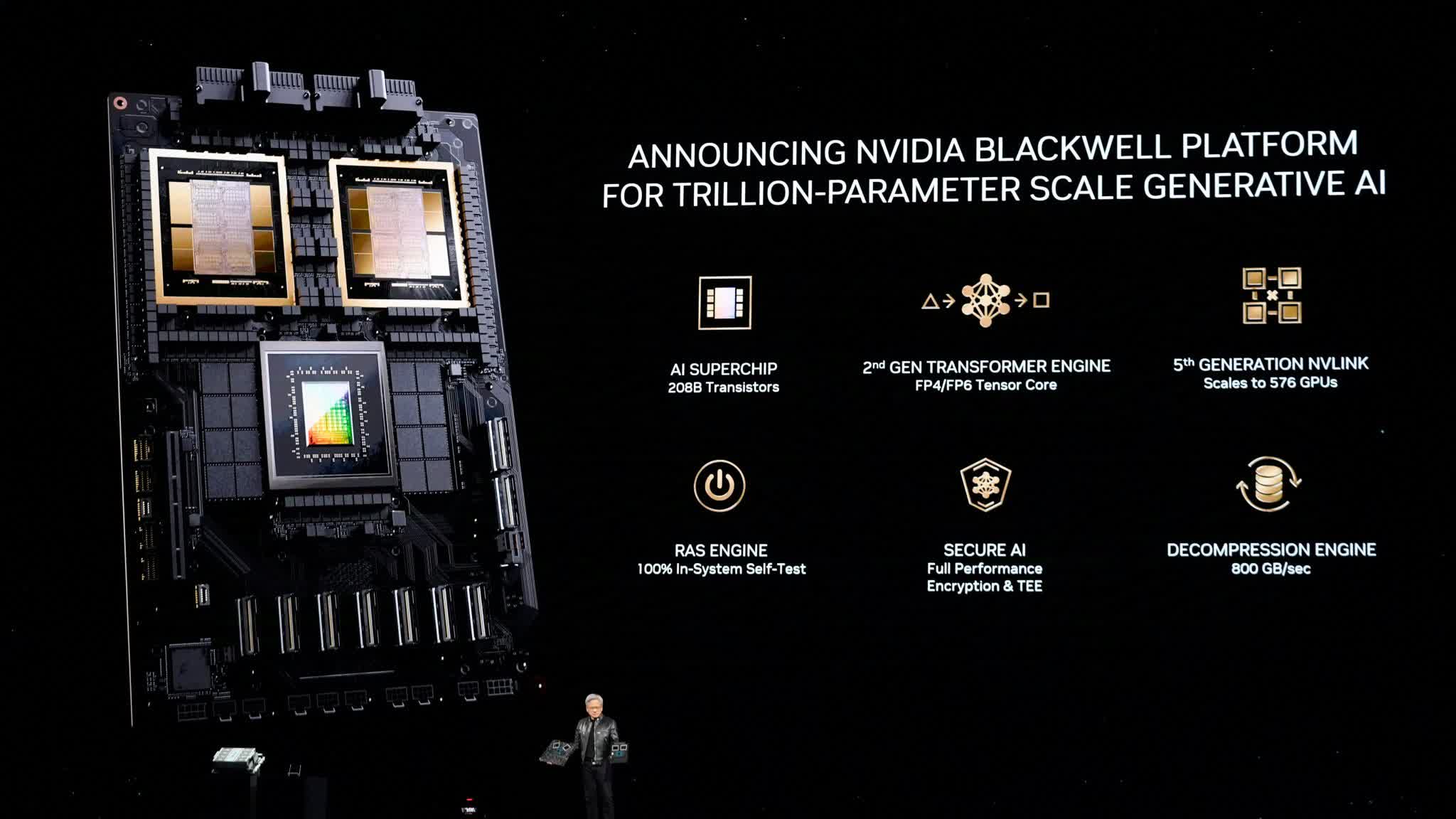

Nvidia and SK Hynix: Starting with technology, SK Hynix announced the mass production of its 12-layer HBM3E for use in AI, which will be used in Nvidia's Blackwell Ultra GPUs. This news is significant as Nvidia already reports that their Blackwell GPUs are sold out for the next 12 months, thanks to the ongoing boom in the AI market. This not only highlights Nvidia's continued leadership in innovation in the AI space but also indicates that the demand for cutting-edge technology is stronger than ever.

Global Finance: In a move that could reshape international financial dynamics, Russia proposed a new payment system for BRICS countries, aiming to reduce dependence on the dollar. Such a development could have profound implications for the global financial market, shifting power and influencing how international business is conducted.

Stock Market and Companies:

- Wall Street hit new records driven by a rally in bank stocks, while Tesla stumbled with robotaxi disappointment. The diversity in performances across different sectors illustrates the complexity of current markets and the importance of a balanced approach to investing.

- Meta Platforms is projected to surpass Alphabet and Amazon in market value by 2026, a clear sign of the growing importance of social networks and virtual/augmented reality in entertainment and daily life.

- US arms deals with Saudi Arabia and the United Arab Emirates, totaling over $2 billion, highlight the ongoing role of geopolitics in the global economy.

China: In terms of the global economy, China announced a 2.3 trillion RMB fiscal stimulus to support its struggling real estate market and the broader economy, a sign of the ongoing challenge that the world's second-largest economy faces.

Cryptocurrencies:

- Bitcoin could reach $150K by the end of the year, according to a market analyst, indicating that volatility and interest in the cryptocurrency market remain high.

- MicroStrategy aims to become the 'leading Bitcoin bank' with $100B-$150B in BTC holdings, reflecting the growing institutional acceptance of Bitcoin as a legitimate investment asset.

- XRP: An analyst predicts that XRP's price could rise to $60, driven by demand and institutional investor capital, signaling potential in the crypto space beyond Bitcoin.

Insights & Suggestions:

1. Technology & AI: The continued demand for Nvidia GPUs and enhanced production from SK Hynix point to a solid investment in leading technology companies at the forefront of AI and computing innovation. Nvidia (NASDAQ: NVDA) remains an attractive choice for investors seeking exposure to exponential AI growth.

2. Diversification and Financial Resilience: Russia's proposal for a new payment system for BRICS countries underscores the importance of diversifying investments to include currencies and alternative assets that may benefit from a possible shift away from the dominance of the dollar.

3. Geopolitics & Defense: US arms deals with Saudi Arabia and the United Arab Emirates reinforce the defense sector as a stable investment. Companies within this sector, particularly those with large government contracts, may offer stability amid geopolitical uncertainties.

4. Cryptocurrency Market: Given the volatility but also the potential for significant value appreciation, Bitcoin and XRP present intriguing opportunities for investors willing to accept higher risk in exchange for the possibility of high returns.

Risks and Opportunities:

While advancements in AI technology and changes in the global financial system present exceptional growth opportunities, they also carry significant risks related to market volatility and political uncertainties. Diversification across sectors, geographies, and asset classes remains strategic to mitigate these risks, while staying attuned to technological changes and government regulations that can dramatically affect the market.