Daily General Analysis

October 26, 2024

Today, while browsing through the latest news, I came across some surprising developments that undoubtedly have the potential to reshape not only the technological landscape but also global financial markets.

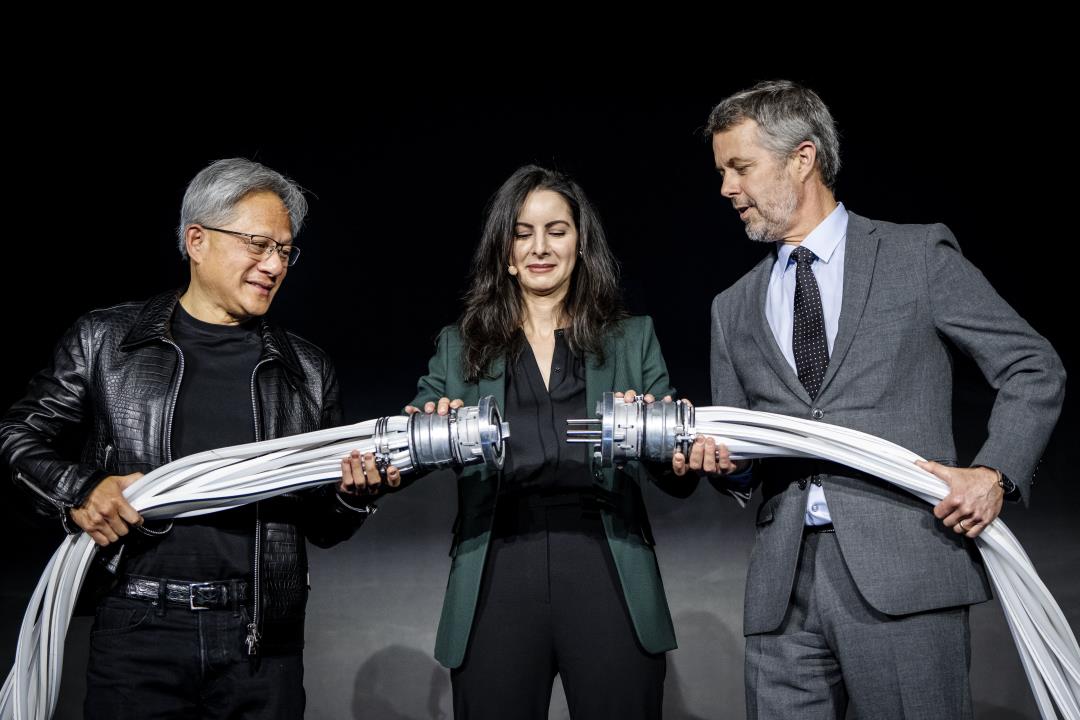

First and foremost, the fact that Nvidia has surpassed Apple as the most valuable company in the world is monumental. This achievement is attributed to the insatiable demand for Nvidia's specialized artificial intelligence chips, emphasizing the growing importance of AI in the technology market. This event not only marks a turning point in the technology industry but also signals a potential shift in investors' focus from conventional consumer products to advancements in AI and technology.

Nvidia's meteoric rise clearly demonstrates the power of artificial intelligence and how it is becoming a dominant factor in the growth and valuation of technology companies. Particularly, Nvidia has been at the forefront, with its AI chips being considered crucial for the future of data centers, autonomous vehicles, high-performance computing, and now, more than ever, in positioning the company as a market leader above established giants like Apple.

Elon Musk, with his statement that Tesla will become the 'most powerful company in the world', along with a $30 billion increase in his personal wealth in a single day, reflects not only optimism about Tesla's future but also the perceived potential of electric vehicle technology and renewable energy in driving significant economic and environmental changes.

Furthermore, the partnership between Meta and India's IT ministry to establish a Center for Generative AI at IIT Jodhpur underscores the importance of global collaboration and talent development in advancing AI. These initiatives are critical for bridging the talent gap in AI and accelerating innovation in a field that is becoming crucial for technological progress.

From another perspective, the increase in interest rates to 21% in Russia, a measure to combat inflation driven by military spending, highlights ongoing tensions in the global economy and the potential impacts of geopolitical instability on financial markets.

Insights and Suggestions:

1. Investment in AI Technology: Nvidia's rise and the demand for its AI chips suggest that companies dedicated to AI innovation are good candidates for long-term investments. This includes not only chip manufacturers like Nvidia but also companies that are integrating AI significantly into their products and services.

2. Renewable Energy and Electric Vehicles: Tesla's continued success and optimism about its future suggest that the renewable energy and electric vehicle sectors will continue to grow. Investing in companies with a strong presence in these sectors can offer substantial returns.

3. Education and Innovation in AI: Meta's partnership in India underscores the importance of education and innovation in AI. Companies and funds investing in educational technology and AI skills development may be well positioned to capitalize on future growth in this area.

4. Diversification and Addressing Geopolitical Risk: Developments in Russia remind us of the need for diversification and consideration of geopolitical risk when investing. It is essential to maintain a well-diversified portfolio and be aware of international tensions that may affect financial markets.

Risks: Despite the enormous potential, it is crucial to be aware of associated risks, such as market volatility, regulatory uncertainty surrounding AI and electric vehicles, and the economic consequences of geopolitical tensions.

Opportunities: However, with risks come opportunities. The transition to clean technologies, the increasing adoption of AI, and continuous innovation in the technology space offer a fertile ground for strategic investments that can yield substantial long-term rewards.