Daily General Analysis

November 17, 2024

Today, some news caught my attention, especially those diving into the world of cryptocurrencies, technology, and global economy. The first major information is that Bitcoin spot ETFs are gaining momentum with the support of the SEC and CFTC. This kind of advancement not only shows greater institutional acceptance of cryptocurrencies but also a search for innovative investments that are environmentally conscious.

On the global stage, the promise of APEC economies to commit to a free and fair trade and investment environment signals a possible decrease in trade barriers and an increase in technical cooperation between countries, something essential in a world facing increasing protectionism and economic uncertainties.

Taiwan is rapidly advancing in semiconductor production, thanks to substantial support from the US, with a $6.6 billion incentive for TSMC in Arizona. This highlights the critical importance of the semiconductor supply chain and the political geography of technological trade.

On the other hand, the opening of the first Chinese port in Chancay, South America, represents a milestone in global trade and shows how China is expanding its influence in global infrastructure, which may reduce costs and transport time between Asia and South America.

In addition, Bitcoin seems to be on track to break the $100,000 barrier, and according to analysts, the sky is the limit, with predictions exceeding $200,000. This news is incredibly optimistic for the cryptocurrency market and for investors who have held Bitcoin long term.

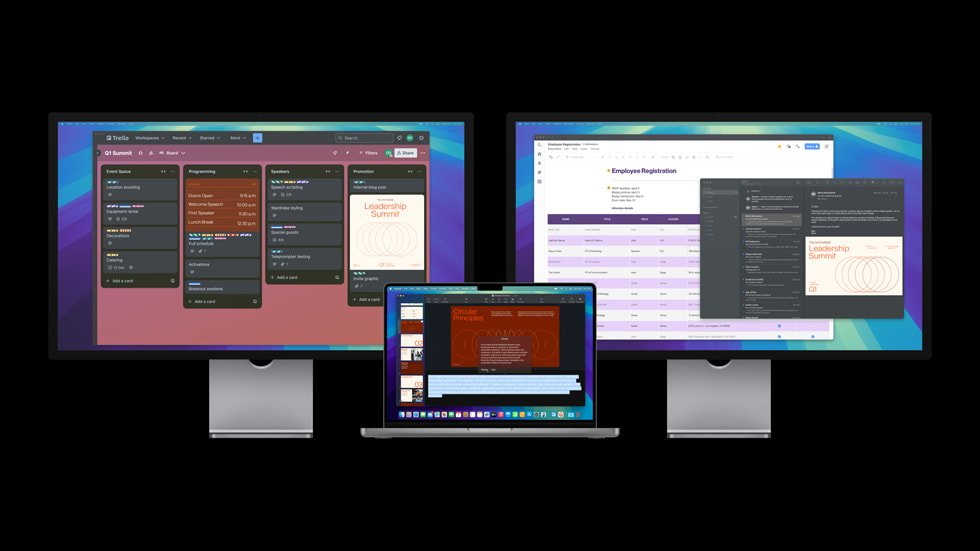

NVIDIA and Apple are also in the spotlight, mainly due to the increasing interest in AI (Artificial Intelligence), which has been a catalyst for the growth of these companies. NVIDIA is positioned for substantial growth driven by demand for AI, while Apple continues to lead the technology market with its own design chips.

Insights and Impacts on the Financial Market

1. Bitcoin and Cryptocurrencies: The growing institutional support for Bitcoin spot ETFs signals a robust investment opportunity in cryptocurrencies. Investors could explore cryptocurrency ETFs or directly invest in Bitcoin as a diversification asset.

2. Technology and Semiconductors: US investment in TSMC and semiconductor development indicate strong future growth for the sector. Investing in leading semiconductor companies or ETFs tracking the technology sector may be a promising strategy.

3. Global Infrastructure: The new Chinese port in Chancay highlights the importance of infrastructure in global trade. This may benefit logistics and maritime transport companies, making them interesting investment opportunities in emerging markets or region-specific markets.

4. AI and Innovation: The increasing demand for AI, evidenced by NVIDIA's success and Apple's innovations, highlights the investment potential in technology companies at the forefront of AI and chip development, either directly or through specialized funds.

Risks and Opportunities

The high volatility of cryptocurrencies, the complexity of global supply chains, and rapid technological advances represent both risks and opportunities. Investors should remain vigilant, diversify their portfolios, and stay informed about global trends to mitigate risks and leverage opportunities in an increasingly interconnected global market.