Daily General Analysis

November 18, 2024

Recently, I delved into an intensive reading on the latest news in the financial and technological world, and some of them really caught my attention, leading me to deep reflections on the future of global markets.

To start with, the strength of the dollar against other currencies, especially the yen, is something we cannot ignore. The high yields of US Treasuries and a more restrained outlook for interest rate cuts make the dollar very attractive. However, tension regarding possible intervention by the Bank of Japan could influence changes in this dynamic.

The movement of Santander paying 150 million in commissions to investment banks is indicative of intense market activity and the appreciation of financial consulting services, which may signal a high environment for mergers and acquisitions or corporate restructurings.

The case of money laundering with Bitcoin involving Larry Dean Harmon, who is expected to give up more than 400 million in assets, once again puts the focus on regulation and monitoring of cryptocurrencies. This could have a direct impact on future regulatory policies and perceptions of security in the crypto market.

Biden's historic visit to the Amazon and the subsequent emphasis on the importance of this ecosystem in the fight against climate change reinforces the urgency of global sustainable policies. This news may be a harbinger of stricter future environmental regulations and increased investment in green technologies.

Taiwan Semiconductor Manufacturing Company (TSMC) receiving $66 billion in subsidies from the US Department of Commerce to advance the production of advanced semiconductor technologies on American soil not only highlights the importance of technological independence and supply chain security, but also suggests a promising outlook for investments in infrastructure and technological innovation.

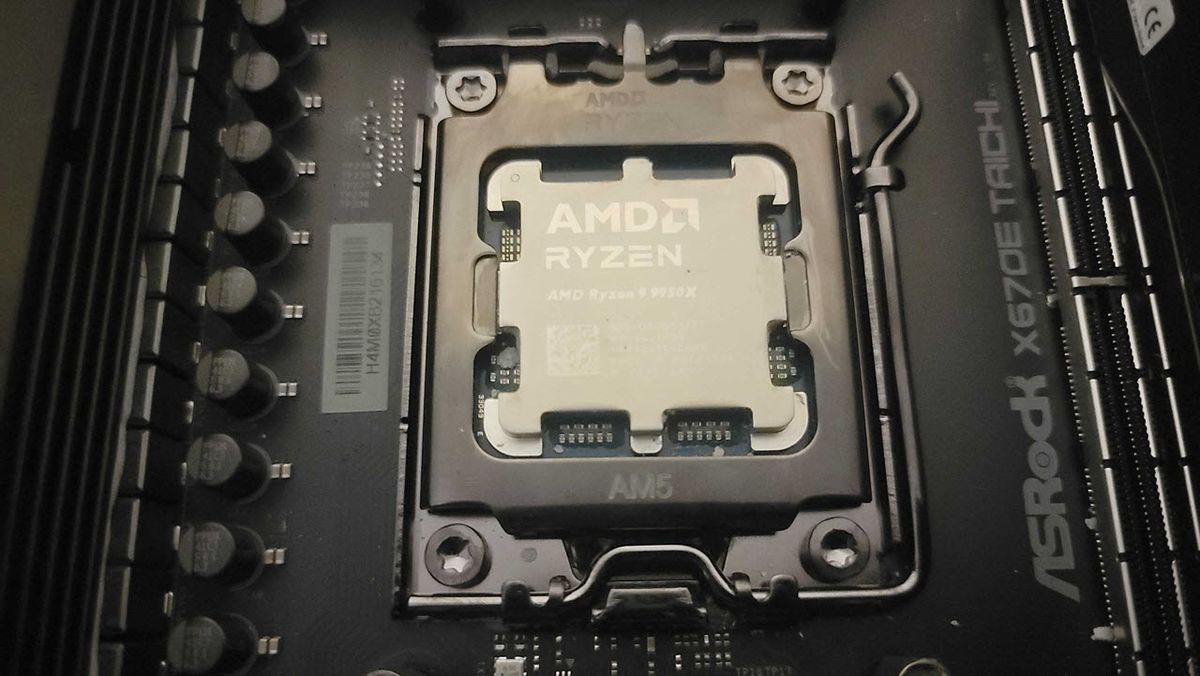

AMD dominating chip sales on Amazon, leaving Intel behind, reflects competitiveness and evolution in the semiconductor market, potentially indicating the direction of technological growth and investments in research and development in the sector.

The discussion of SpaceX about selling internal shares valuing the company at $255 billion highlights the growing interest and confidence in the space exploration sector and satellite technologies, suggesting an area of investment with significant growth potential.

The introduction of the BITCOIN Act of 2024 proposes a paradigm shift in the US financial strategy, leveraging cryptocurrencies within national economic policy. This could signal a new era of acceptance and integration of cryptocurrencies into mainstream finance, presenting risks and opportunities for investors.

The above news provides a fairly diverse overview of the current state of the global market and its possible future directions. Investing in clean technologies, for example, becomes increasingly attractive as governments and companies seek to mitigate climate change. Semiconductor companies, such as TSMC and AMD, stand out as solid investments given the critical role they play in the global digital economy. With the evolution of the cryptocurrency market, new investment opportunities are opening up, although accompanied by a need for more stringent regulatory oversight.

It is also important to consider geopolitical and regulatory risks, especially regarding emerging technologies and cryptocurrency volatility. However, diversification in sectors such as technology, clean energy, and semiconductors seems to offer a promising path for long-term growth.

Investing in companies leading in innovation and sustainability or even exploring the growing market of cryptocurrency ETFs can offer a balanced exposure to these trends with manageable risk. As always, the key is research and careful analysis before making investment decisions.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25535403/STK004_FBI_CVIRGINIA_A.jpg)