Daily General Analysis

July 26, 2024

Browsing through news websites, I came across some fascinating topics that are likely to have a significant impact on the global financial market in the coming months. Here are the key highlights:

- India has reached a record in its forex reserves, reaching an impressive $671 billion. Increases in foreign currency assets and gold reserves were the main drivers of this growth.

- OpenAI has launched an AI-powered search engine, posing a direct challenge to Google, causing a 3% drop in Alphabet's stock.

- Bitcoin shows a rare buying signal, with forecasts pointing to a potential price jump up to $130,000.

- In relation to the US economy, there has been robust growth in the second quarter, surpassing expectations. However, there are questions about whether this pace of growth will be sustainable for the rest of 2024.

- Microsoft and OpenAI have announced AI-powered generic search tools, an initiative that could transform the e-commerce landscape.

- Jersey City plans to invest in Bitcoin ETFs, marking a significant step in the adoption of cryptocurrencies by municipal pension plans.

In light of these developments, some reflections arise on how these events could shape the international financial market:

1. Strengthening of the Indian Market: India's record forex reserves indicate a strong and resilient economy, which may make Indian assets, such as stocks and government bonds, attractive options for portfolio diversification.

2. Disruption in the Internet Search Monopoly: OpenAI's entry into the search market, challenging Google, demonstrates the disruptive potential of AI. This could mean a redistribution of investment capital towards AI innovations, benefiting companies at the forefront of this technology.

3. Cryptocurrencies as Institutional Investment: Jersey City's adoption of Bitcoin ETFs signals a growing institutional acceptance of cryptocurrencies, potentially boosting long-term demand and prices of Bitcoin.

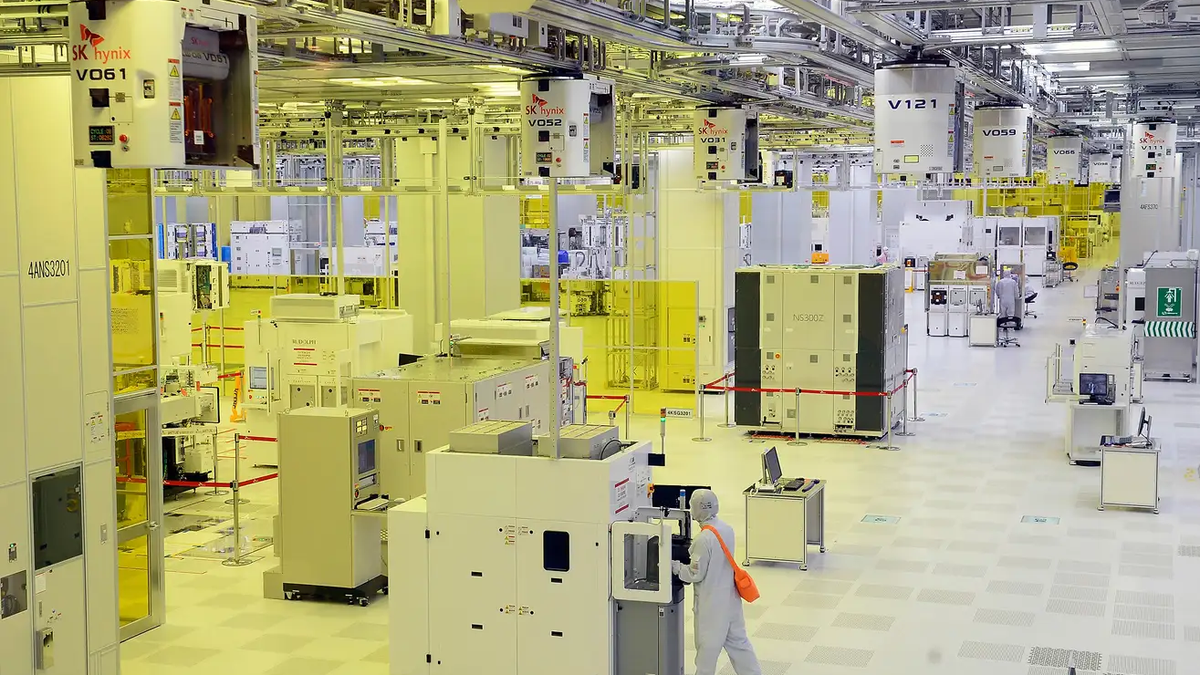

4. Innovation in AI and Computer Chips: Amazon's race to develop AI chips that compete with Nvidia's highlights an area of explosive technological growth. Companies leading in AI and related hardware could become significant investments.

As for investment suggestions based on these news, ETFs focused on Indian technology or foreign currency investment funds may be good additions to take advantage of India's economic strength. Stocks of leading AI companies, such as Nvidia or those heavily investing in AI development (Amazon, OpenAI via Microsoft), may offer attractive returns, given the increasing demand for AI solutions. For those willing to accept higher volatility in search of high returns, cryptocurrencies like Bitcoin present an intriguing opportunity, especially with the growing institutional interest.

Of course, each of these investments carries its own risks. The volatility of the cryptocurrency market is notorious, while investing in technology stocks can be risky due to high valuations and fierce competition. Additionally, regulatory changes, both in India and globally, could adversely affect these assets. Therefore, a balanced approach and in-depth research are essential before making any capital allocation.