Daily General Analysis

August 17, 2024

Today, while browsing the internet, I came across quite intriguing news that seems to paint a comprehensive picture of current market movements and global geopolitical tensions. News that, in my opinion, may have significant implications for the international financial market.

Franklin Templeton, the Wall Street giant, made decisive moves by entering the world of digital assets, with an application to launch an ETF fund indexed to cryptocurrencies, focusing on Bitcoin and Ethereum. In a world where trust in fiat currencies is wavering, this move signals broader institutional adoption of cryptocurrencies, potentially increasing their legitimacy and adoption by traditional investors.

Furthermore, the urgent need for a Europeanized NATO is highlighted amid growing geopolitical tensions. The constant threat from Russia, along with possible coordinated actions from nations like China, Iran, and North Korea, signals a period of instability that could have significant implications for the European and global stock markets, especially in the defense sector.

The price of gold has surged, breaking records and reaching over $2500 per ounce. This rise is driven by a mix of expectations of rate cuts by the Federal Reserve, a weakening dollar, and geopolitical uncertainties, particularly in the Middle East. Traditionally a safe haven, gold seems to be reclaiming its role as a refuge in times of uncertainty.

Saudi Arabia is on a high-risk mission to globalize its investments, through its Public Investment Fund. By investing in globally diversified companies and sectors, from Uber to Blackstone and even in sports with LIV Golf, the country is trying to position itself as a major player in the global investment landscape.

Among all, the predictions for Bitcoin to reach $200,000 by 2025 draw attention to the growing optimism about the future of cryptocurrencies as a legitimate and potentially profitable investment asset.

### Insights and Implications in the Financial Market:

1. Institutional Adoption of Cryptocurrencies: Franklin Templeton's entry into the crypto space suggests increasing institutional adoption that could lead to increased confidence and value of major cryptocurrencies. Suggested investment: consider cryptocurrency ETFs or directly in Bitcoin and Ethereum.

2. Geopolitical Tensions and Defense: The Europeanization of NATO and tensions in the Middle East may increase demand for defense and security. Suggested investment: stocks of defense companies and security technology.

3. Rise of Gold as a Safe Haven Asset: The rush to gold signals global uncertainty. Suggested investment: gold bars, gold ETFs, and shares of gold miners.

4. Diversification through Saudi Investments: Saudi Arabia's investment strategy indicates potentially lucrative sectors. Suggested investment: monitor the movements of the Saudi Public Investment Fund and consider investments in specific sectors and companies where they are heavily investing.

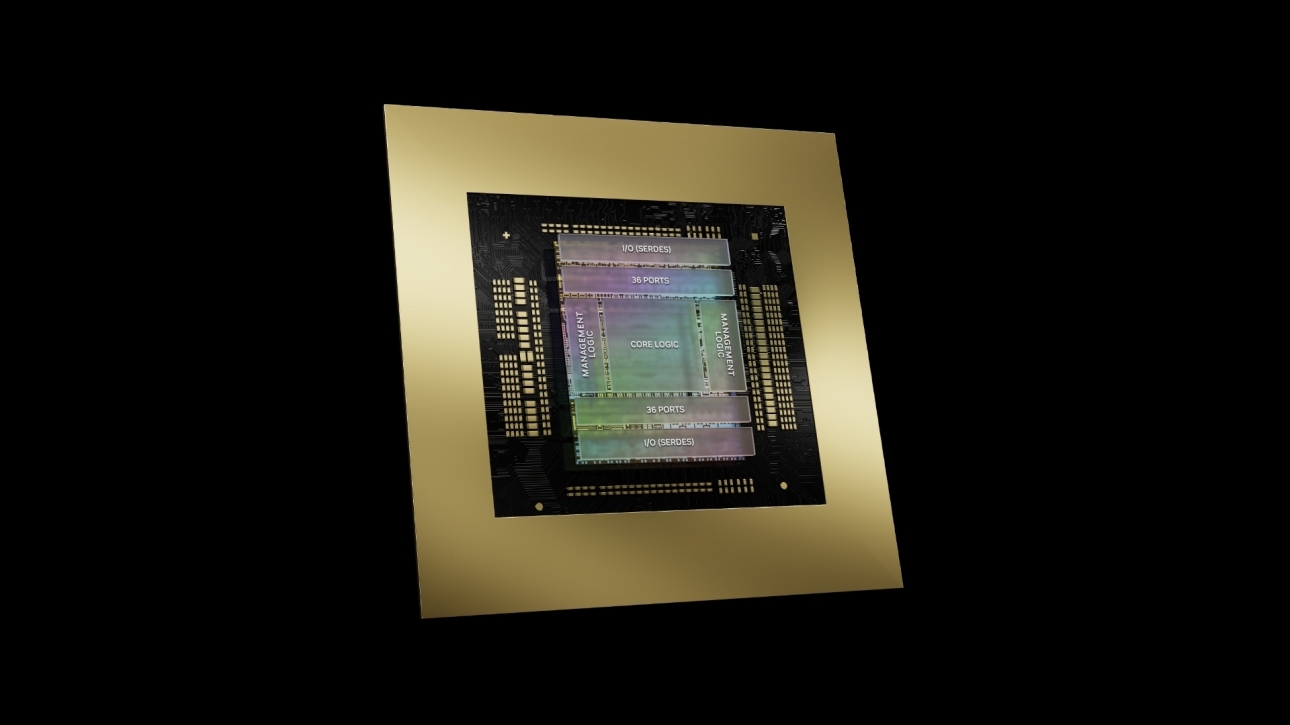

5. Evolution of AI and Technology: With Nvidia leading the race for AI supremacy, its investment in fundamental technologies like NVLink and NVSwitch positions the company as a potential giant in the future of AI. Suggested investment: Nvidia stocks and other AI innovators.

### Risks and Opportunities:

Geopolitical risk, particularly in the Middle East and concerning Russia, may negatively affect global markets, but also offers opportunities in defense and security technology sectors. Institutional adoption of cryptocurrencies brings volatility but also significant growth potential. The rise in the price of gold confirms the trend of seeking security in tangible assets, while Saudi investment diversification and advances in AI present opportunities for those willing to invest in innovation and global growth.

To navigate these uncertain times, a diversified investment strategy, including cutting-edge technology, tangible assets like gold, and careful attention to geopolitical changes, seems to be the most prudent approach.

:format(jpg):quality(99):watermark(f.elconfidencial.com/file/bae/eea/fde/baeeeafde1b3229287b0c008f7602058.png,0,275,1)/f.elconfidencial.com/original/d51/08f/fc3/d5108ffc373eadec8507c69a6a27fe02.jpg)