Daily General Analysis

August 19, 2024

The day's observations on the global financial and technological market bring a mix of optimism, innovation, and geopolitical and economic challenges that can significantly influence investment decisions in the near future.

The highlight of the moment is the historic peak in the S&P 500, Dow Jones, and Nasdaq, driven by giants like Nvidia, Microsoft, and Alphabet. This movement confirms the ongoing strength of the technology sector, highlighting the importance of considering these companies in any diversified stock portfolio.

Goldman Sachs and its substantial $400M bet on Bitcoin ETFs reflect a growing interest and institutional validation of cryptocurrencies. This move could signal a turning point in how digital currencies are perceived in mainstream finance, suggesting growth potential for the crypto market.

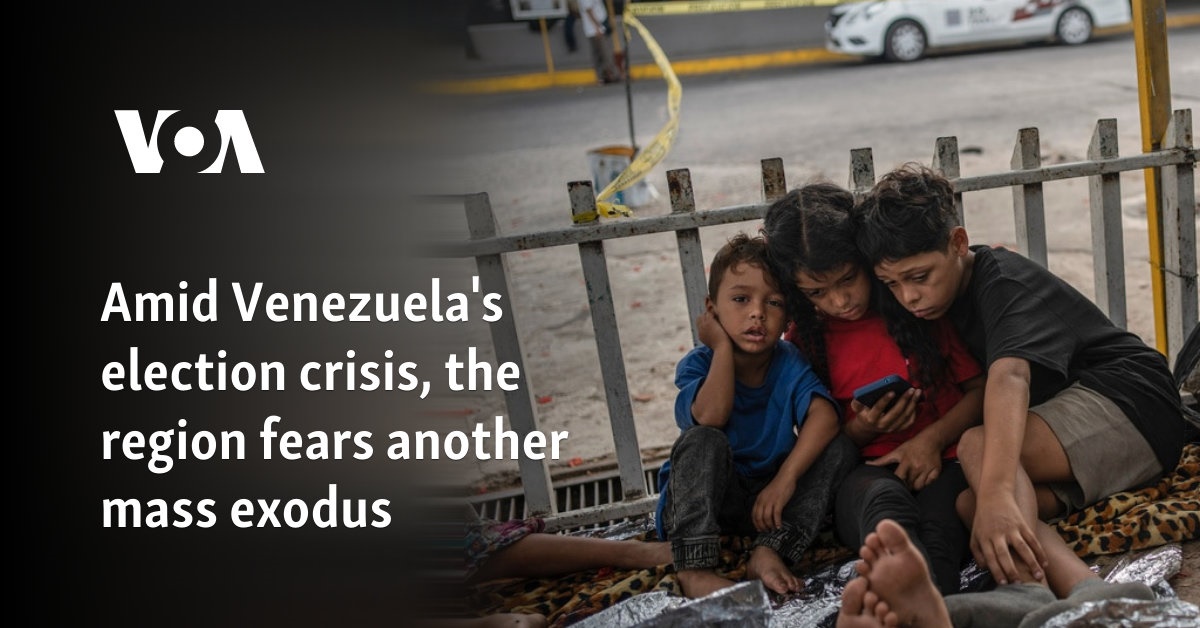

The below-potential oil production in Venezuela highlights a significant imbalance that could affect global oil prices, especially in a context of geopolitical uncertainties and increasing demand. Investing in companies or funds with exposure to the energy sector may be an interesting way to capitalize on potential price adjustments.

The rise in the price of gold and the forecast of a jump to $3000 indicate a significant shift in the perception of gold as a safe haven. With increasing geopolitical tensions and central banks diversifying away from the dollar and the yuan, gold emerges as an increasingly attractive investment for long-term capital preservation.

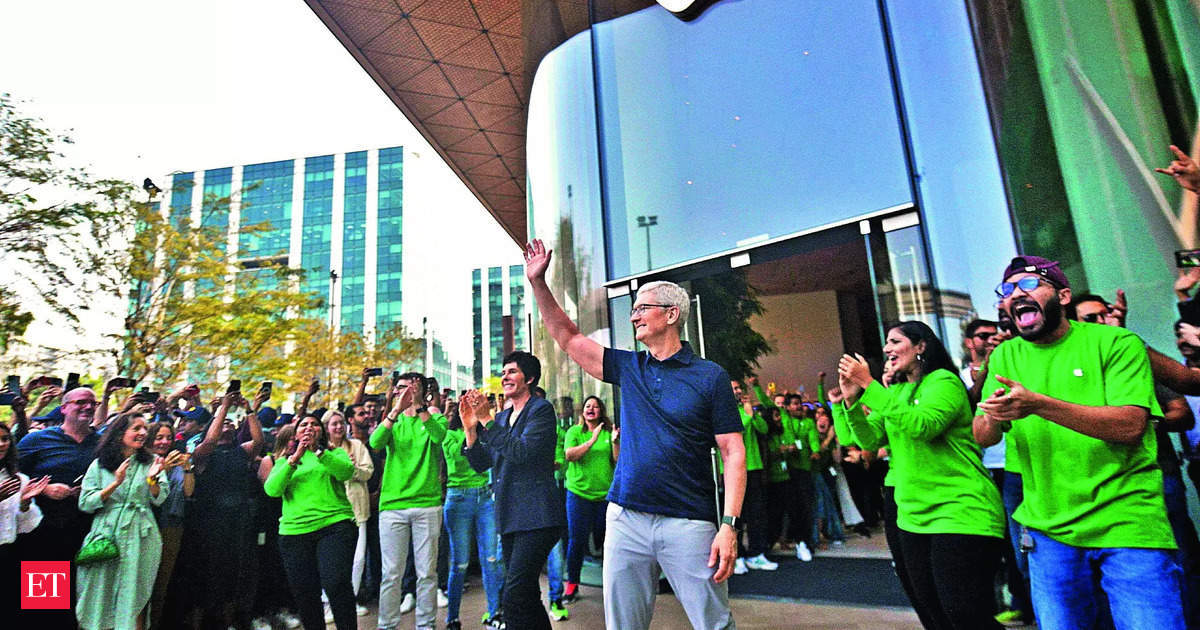

The performance and expansion of Apple, especially with its business value surpassing ₹2 lakh crore in India, reinforces the strength of this company as an investment. Together with the merger of AI chip startups in South Korea, it points to the growing importance of technology and innovation as drivers of growth and competitiveness on a global scale.

### Insights and Investment Suggestions:

1. Technology and AI: With Nvidia and the merger between Rebellions and Sapeon Korea, there is a strong case for investing in leading technology and innovation companies, particularly those focused on AI and semiconductors. ETFs tracking the technology or semiconductor sector are worth considering investments.

2. Cryptocurrencies: Goldman Sachs' investment in Bitcoin ETFs demonstrates the increasing institutional adoption of cryptocurrencies. Investors interested in diversification may consider allocating a portion of their portfolio to crypto assets, preferably through regulated investment vehicles to mitigate risks.

3. Energy and Commodities: The situation in Venezuela and the gold forecast indicate potential for investments in commodities, including oil and gold. Funds focusing on commodities or specific gold ETFs may benefit from fluctuations due to geopolitical instabilities.

4. Tech Giants: Companies like Apple, Microsoft, and Alphabet continue to demonstrate strength and growth, making them robust choices for long-term investment. Considering individual stocks or ETFs that focus on these and other tech giants can offer a good mix of growth and stability.

### Risks to Consider:

- Crypto Volatility: Despite optimism around cryptocurrencies, they remain highly volatile and sensitive to global regulatory changes.

- Politics and Oil: Oil investments can be affected by political decisions and instabilities in producing regions, such as Venezuela.

- Inflation and Gold: While gold is seen as a safe haven, its performance may be influenced by central bank policies affecting inflation.

With these trends and considerations in mind, it is clear that we are at a potential turning point in the global market. The key to successful investing will be diversification, ongoing research, and a keen eye on emerging opportunities as the global economic landscape continues to evolve.