Daily General Analysis

September 11, 2024

Today, delving into the depths of the internet in search of the latest news, I came across some headlines that really caught my attention and deserve a deeper analysis. Here are the highlights:

- Amazon announced a whopping $10 billion investment in data centers in the UK. This move not only strengthens Amazon Web Services (AWS) cloud computing and artificial intelligence (AI) infrastructure in Europe but also puts the company in an even more competitive position against giants like Microsoft and Google.

- On another front, Apple faces a significant setback with the European Union Court ruling that it must pay $14 billion in back taxes to Ireland. This verdict directly impacts Apple's finances and possibly its European operations.

- Standard Chartered Bank has obtained a license to offer cryptocurrency custody services in the United Arab Emirates, marking a significant turning point for institutional acceptance of cryptocurrencies.

- The judicial reform in Mexico, according to analysts, may create an unfavorable economic environment, directly affecting the confidence of foreign investors and potentially the country's investment grade.

- Transocean Ltd. secured a $232 million contract for ultra-deepwater drilling operations, highlighting the continued demand for oil and gas exploration even amidst global discussions on energy transition.

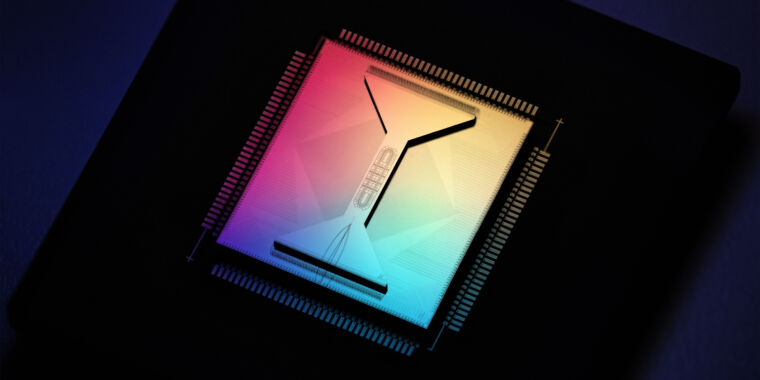

- Nvidia, a giant in the AI and graphics processor sector, faced a massive loss of $470 billion in market value, despite still being considered by many analysts as a promising long-term investment, especially with the growing demand for AI and high-performance computing.

- Taiwan Semiconductor Manufacturing Co recorded an impressive 33% growth in its August sales, signaling strong demand for semiconductors, driven by AI advancements and new iPhone releases.

Insights and Investment Suggestions:

1. Technology and AI: Amazon's continued expansion in the UK and the significant developments of Nvidia and Taiwan Semiconductor point to a future where technology and artificial intelligence play central roles. Investing in technology and AI companies' stocks, such as Amazon, Nvidia, and Taiwan Semiconductor, may be a smart long-term move, given the increasing demand across all industries.

2. Cryptocurrencies and Custody Services: Standard Chartered Bank's entry into the cryptocurrency custody services market in the UAE indicates a greater institutional acceptance of cryptocurrencies. Investing in financial companies expanding to include cryptocurrency services can offer good diversification for investment portfolios.

3. Energy and Exploration: Transocean Ltd.'s contract with bp reveals the ongoing need for oil and gas exploration. Stocks of companies involved in energy exploration and production remain relevant for investors with a long-term view, especially as the world transitions to more sustainable energy sources.

4. Focus on the European Market: The tax penalty imposed on Apple and judicial reforms in Mexico are critical reminders of geopolitical and regulatory risks. Geographical diversification in investments and attention to local policies are essential to mitigate unexpected risks.

In summary, as the investment landscape continues to evolve, embracing technology, considering the growing acceptance of cryptocurrencies, staying informed about geopolitics, and exploring opportunities in energy are key strategies. As always, diversification is crucial for a healthy and resilient investment portfolio.

![Nvidia is a bargain now that AI is going beyond the hyperscalers, should reach ludicrouscalers in the near future [PSA]](https://img.fark.net/images/2013/site/farkLogo2Big.gif)