Daily General Analysis

September 23, 2024

Today, I delved into some fascinating news that paints an intriguing picture of the global financial and technological landscape. Let's analyze some of the most notable stories that caught my attention.

Mercado Libre, the e-commerce giant in Latin America, has launched its own stable cryptocurrency, "Meli Dollar" (MUSD), in Mexico. In a world where the volatility of cryptocurrencies like Bitcoin and Ethereum often concerns investors, Mercado Libre's initiative to offer a stablecoin pegged to the US dollar could be a real game-changer. Furthermore, this innovation suggests the company's commitment to financial digitization in the region.

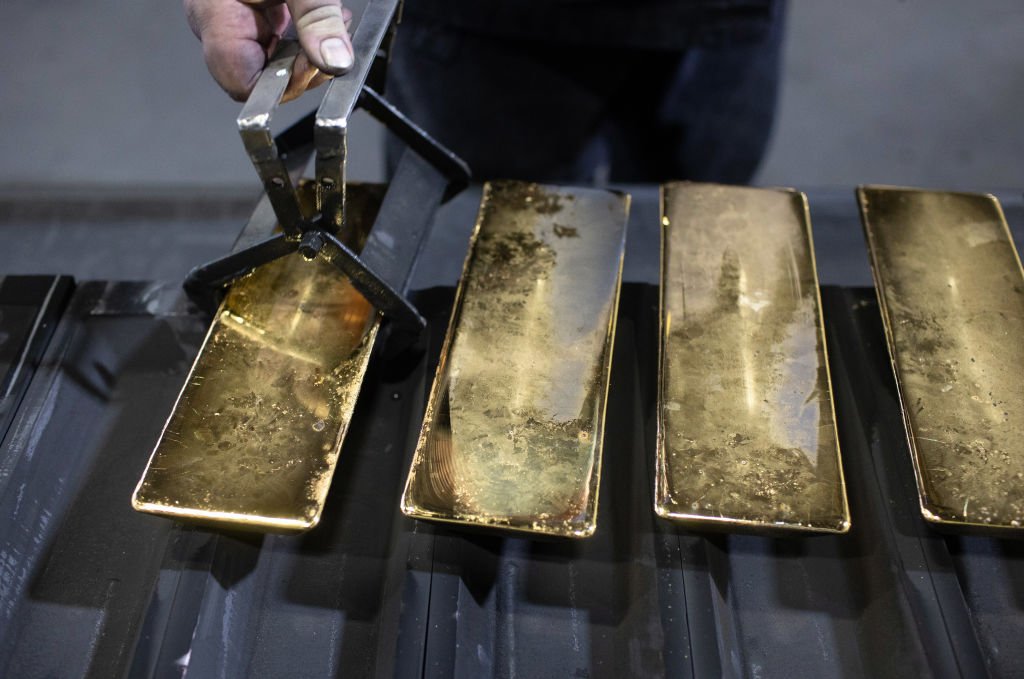

On the other hand, the Fed (Federal Reserve of the US) has decided on a rate cut, which propelled the price of gold to new historic highs. The precious metal surpassed $2,628.65 per ounce, reaffirming its status as a safe haven asset in times of economic uncertainty.

In technology, Nvidia continues to dominate headlines with its exceptional performance thanks to the artificial intelligence boom, while China strengthens its commitment to Africa, promising $50 billion in investments, mainly focusing on renewable energies and mining, aiming to solidify its influence on the continent.

In the semiconductor sector, both TSMC and Samsung are considering building large factories in the United Arab Emirates, a move that could not only realign the geopolitics of chip manufacturing but also significantly impact the global supply chain.

Insights and Implications for the Financial Market:

1. Stable Cryptocurrencies and Digital Trade: The launch of MUSD by Mercado Libre may indicate that stablecoins will play an increasingly central role in the digital economy. Investing in technology companies expanding their digital financial offerings could be a smart move.

2. Gold as a Safe Haven: With the recent rate cut by the Fed and the consequent increase in the price of gold, the importance of having gold or gold-related ETFs in a diversified portfolio, especially in periods of economic uncertainty, becomes evident.

3. AI and Semiconductor Boom: The continued growth of Nvidia and the expansion plans of TSMC and Samsung underline the critical importance of semiconductor technology. Stocks of chip companies, especially those involved in AI, may offer significant returns.

4. Geopolitical Influence and Renewable Energies: China's investment in Africa, focusing on renewable energies, highlights the growth potential in this sector. Investments in renewable energies, especially in emerging markets, may be an excellent long-term opportunity.

Risks and Opportunities:

- Stablecoins like MUSD face significant regulatory risks that can affect their growth.

- Gold volatility in response to monetary policy decisions offers trading opportunities but also presents risks.

- Investment in semiconductors carries the uncertainty of the supply chain, particularly with new factories in geopolitically sensitive locations.

- The renewable energy sector is promising but depends on continuous political support and technological advancements.

In summary, today's news provides valuable insights into where we can find growth opportunities and how we can mitigate risks in our investment portfolio.

![Apple Watch 10: The best gets gloriously better [Review] ★★★★★](https://www.cultofmac.com/wp-content/uploads/2024/09/Apple-Watch-10-with-Apple-Sport-Loop-band.jpg)