Daily General Analysis

July 22, 2024

Today, while browsing the internet, I came across several news of great relevance in the world financial and geopolitical scenario. What caught my attention the most was the shift in focus of concerns from sovereign wealth funds and central banks. According to a survey by Invesco, geopolitical conflicts now outweigh inflation as the biggest concern among managers overseeing around $22 trillion in assets. This signals a significant change in investment priorities and possible future strategies.

Another highlight is the performance of the cryptocurrency Solana, which led an impressive surge in the market, with expectations growing for it to surpass $200. Concurrently, information about massive offerings of Bitcoin ETFs and BlackRock's investments in its Bitcoin IBIT ETF, despite an overall bearish scenario, reveal a growing trend of interest in crypto assets.

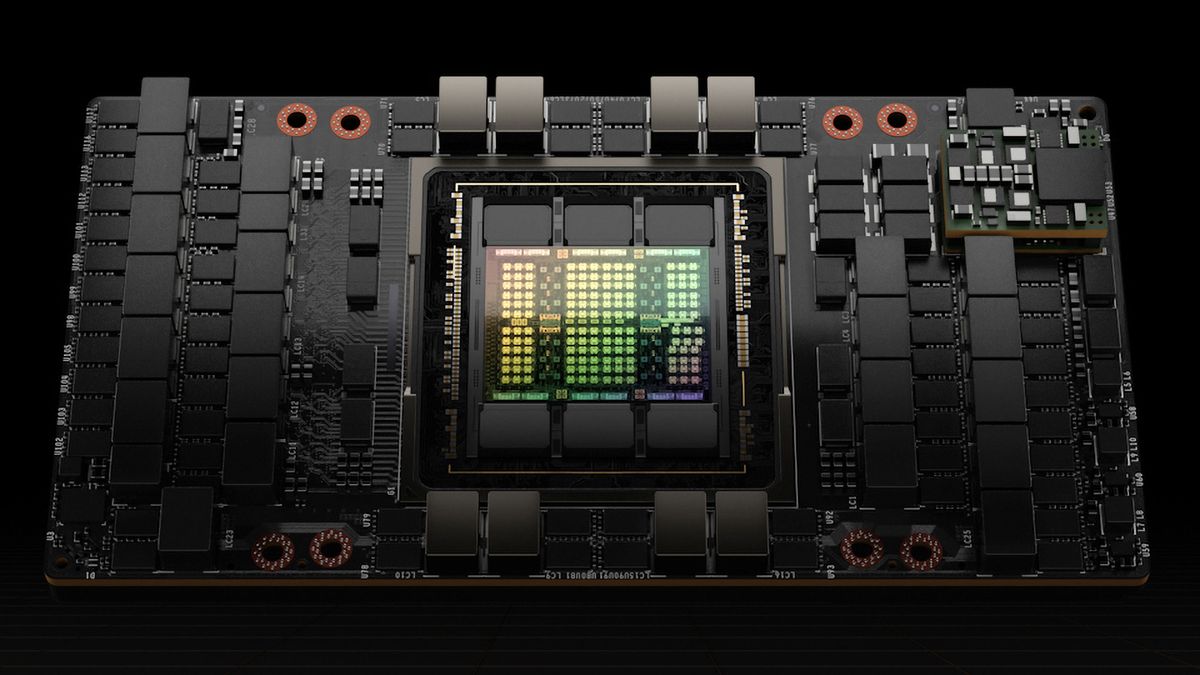

In the technology field, the spotlight is on the Taiwan Semiconductor Manufacturing Company (TSMC), whose price target was raised by analysts, even amidst volatile market and the recent decline in tech stocks. Additionally, there are concerns related to Nvidia and the risk of losing up to $12 billion in revenue if the US bans its new GPUs focused on China. This highlights the delicate balance that technology companies need to maintain amid increasing geopolitical tensions.

Analyzing these points, I believe the international financial market is on the verge of significant restructuring, driven by profound geopolitical changes, technological advancements, and the growing adoption of crypto assets. Here are the most relevant insights and implications of this news:

1. Increased geopolitical relevance: Conflicts and tensions between major powers, especially between the US and China, can cause instability in global markets. Geographical diversification becomes even more crucial in investment portfolios to mitigate risks associated with these disputes.

2. Rise of cryptocurrencies: The continued interest and growth of assets like Bitcoin and Solana, especially in times of economic uncertainty, reinforce cryptocurrency as an emerging asset class to be considered for portfolio diversification.

3. Advancements and risks in technology: The increasing dependence of the world on technological innovations, such as semiconductors, puts companies like Nvidia and TSMC in the spotlight. Investors should be mindful of the vulnerabilities of these companies to government policies and trade conflicts.

4. Gold as a refuge: With gold price forecasts reaching $2,600 by the end of the year, according to UBS, gold remains an excellent defensive investment option, especially in times of political insecurity and economic instability.

In terms of investment strategies, diversifying into cryptocurrencies like Bitcoin or investing in ETFs related to crypto assets, may be a good option to capitalize on emerging trends. Furthermore, considering tech stocks that demonstrate strong fundamentals and resilience to geopolitical dynamics, and maintaining an allocation in precious metals like gold, can provide effective protection against market volatility.

Despite the opportunities, it is crucial to be aware of the uncertain environment and the risks inherent in investing in highly volatile assets or sectors sensitive to geopolitical conflicts. Therefore, the key is to maintain a well-balanced portfolio, with a healthy mix of defensive and offensive assets, to successfully navigate this challenging economic landscape.