Daily General Analysis

August 25, 2024

Analysis of the Global Financial Market: Perspectives and Investment Strategies

Recently, I came across a series of fascinating news that undoubtedly have significant implications for the global financial market.

Firstly, Kamala Harris' campaign for the US presidential elections has shown a remarkable financial boost, accumulating $540 million in donations since its inception. This fact is an indicator of substantial financial and political support, reflecting possible future trends in US economic policy.

On another note, an announcement made by Federal Reserve Chairman, Jerome Powell, about interest rate cuts in the US signals a new phase in the country's monetary policy. Powell also referred to unemployment as the primary concern now, rather than inflation, promising measures to prevent a recession in the US.

On the international front, Taiwan has seen a significant advancement by surpassing South Korea in terms of per capita GDP. Much of this success is attributed to the Taiwan Semiconductor Manufacturing Company (TSMC), emphasizing the crucial role of the semiconductor industry.

Furthermore, global markets received a warning from Diego Parrilla, Chief Investment Officer at Quadriga Asset Managers, about the imminent burst of a "massive financial bubble". A concerning prediction that suggests heightened attention to market signals.

In terms of geopolitics, the US's continued support for Ukraine with an additional military aid package of $125 million against Russia shows the persistent international tension that could have global economic ramifications.

Volvo Group is investing $700 million in a new plant in Monterrey, Mexico, a decision that reflects the growing integration of the global economy and interest in more diversified supply chains.

Key Insights:

1. Politics and Economics: The significant funding of Kamala Harris' campaign and the Federal Reserve's policy changes illustrate the intersection between politics and economics. Investors should be vigilant about future policies as they may impact sectors like technology, healthcare, and energy.

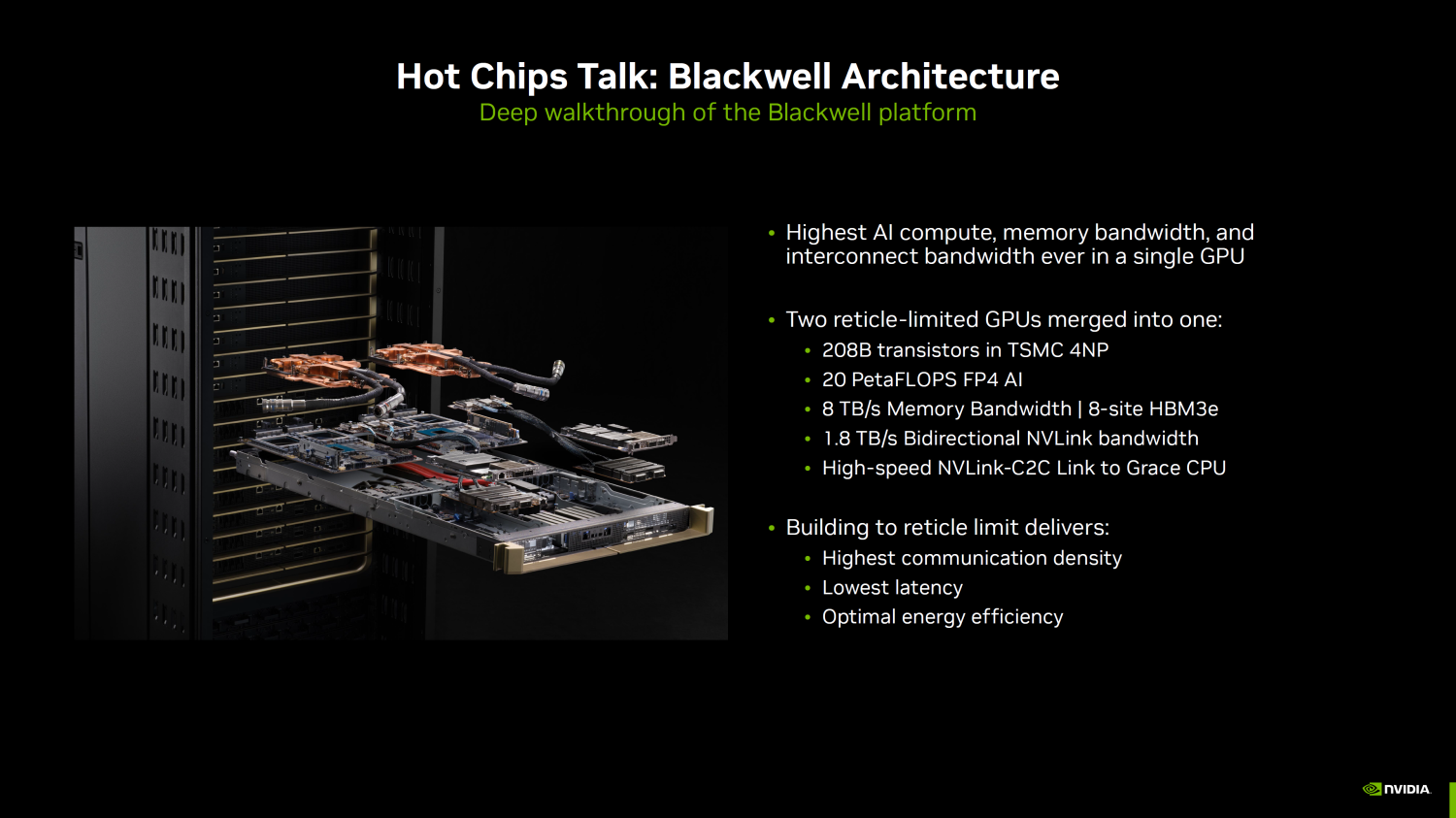

2. Technology and Semiconductors: The success of TSMC and the increased investment in AI, as evidenced by the growth of Nvidia, affirm technology and semiconductors as areas of sustainable growth. This suggests that investing in leading semiconductor companies may be a promising strategy.

3. Geopolitics: Ongoing tension between Russia and Ukraine, with US involvement pointing to potential disruptions in commodities, especially in the energy sector. Diversifying into commodities can serve as a hedge against these uncertainties.

4. Financial Bubble: With the warning about a possible financial bubble, it is prudent to diversify portfolios and consider assets considered safe, such as treasury bonds and gold, as protection against potential market corrections.

Investment Strategies:

- Technology Stocks: Companies like Nvidia, at the forefront of AI innovation, represent considerable long-term opportunities.

- Safe Haven Assets: Given the forecast of a tumultuous market, gold and bonds can offer the necessary stability in a diversified portfolio.

- Cryptocurrencies: With the expectation of a spot ETF for Solana in 2025, renewed interest in crypto assets could represent an attractive investment opportunity, albeit with inherent high risks.

Conclusion:

The current scenario, full of technological advances, geopolitical changes, and adjustments in US monetary policy, offers both risks and opportunities for investors. Diversification strategies, attention to emerging trends in technology and semiconductors, and careful analysis of geopolitical developments are essential to navigate this complex landscape and take advantage of emerging opportunities.